Get in touch with our certified consultants and experts to explore innovative solutions and services. We've empowered companies across various domains to transform their business capabilities and achieve their strategic goals. Schedule a Call

Revolutionizing Digital Finance with a Secure Fintech App

Highlights

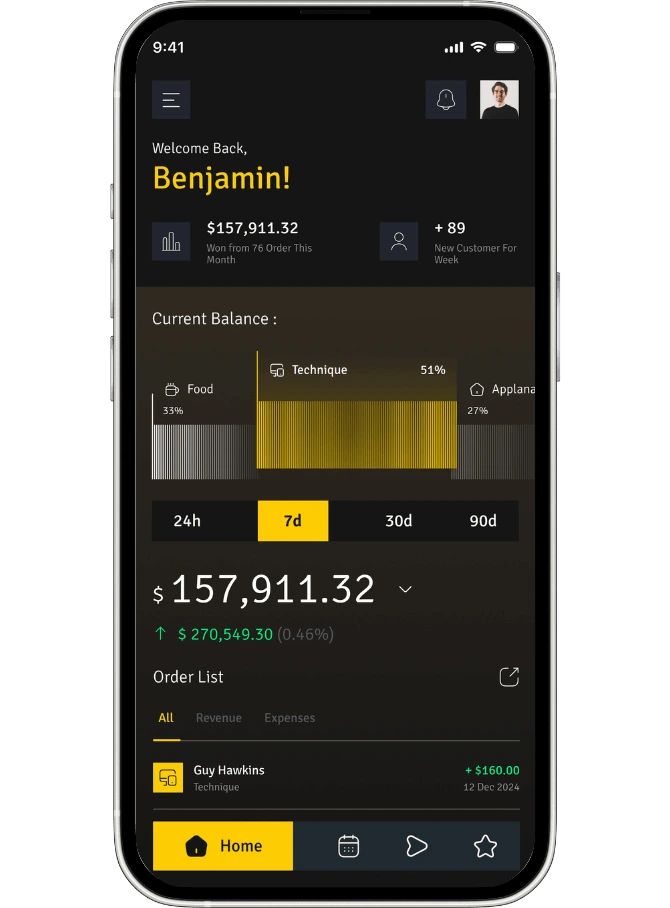

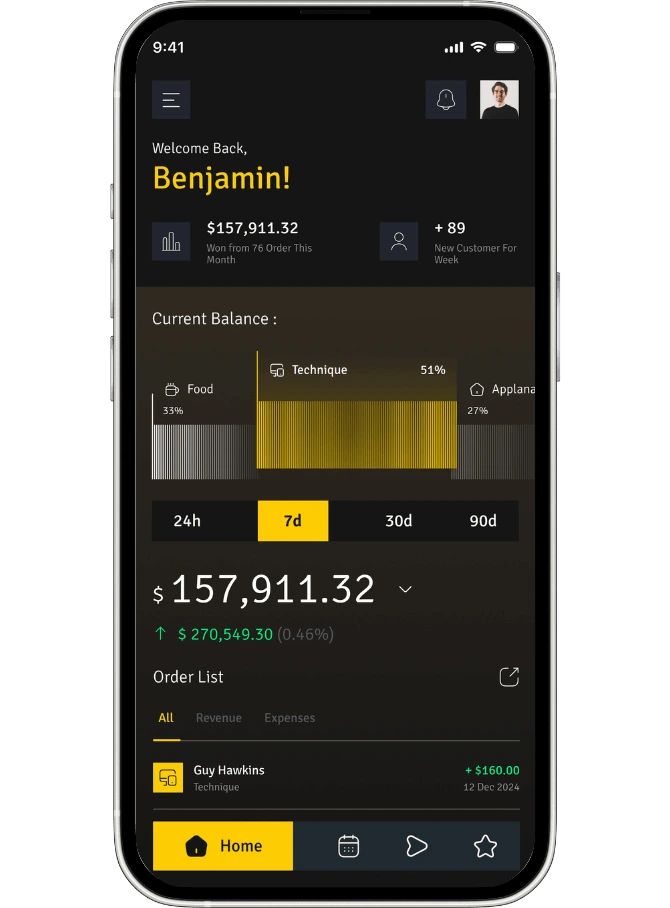

We delivered a fully digital financial platform for users through the development of a fintech mobile app. The application gives users safe money transfer capabilities alongside automatic billing functions and instant transaction monitoring services. Users can access AI-powered financial analysis through this platform, which provides insights about their spending patterns, saving potential, and investment possibilities.

Advanced security features such as end-to-end encryption and biometric authentication and AI-based fraud detection provide the highest level of data protection for the app. The platform guarantees trustworthy and non-modifiable transaction records through its blockchain implementation, which strengthens both data protection and transparency.

The smooth financial experience relies on both user-friendly user interfaces alongside dependable backend capabilities, which serve individual users along with corporate users who need bulk transaction support.

Security & Compliance Adherence

The primary business concern focused on making sure data remained financially secure. It includes multiple secure layers using encrypted data transmission alongside PCI DSS regulations and biological authentication. Artificial intelligence-based fraud detection ran in real time to function as an integral security structure for blocking unlawful payments.

Scalability for High-Volume Transactions

The FinTech application needed operational features that could handle substantial user volume coupled with many transactions. The peak operation period was maintained by smooth performance due to microservices architecture hosted on the cloud and their reinforced backend structure.

AI-Driven Financial Intelligence

Money-related insights coupled with recommendations formed the core of the application interface demands made by the end customer. Available savings avenues and suggested investment alternatives accompany user-spending data analysis through AI algorithms, which the app delivers to its users.

Secure Digital Transactions

The application allows users to transfer funds instantly while supporting payments against bills and managing funds. The application provides secure end-to-end encryption for transactions, which allows users to create payments using UPI, credit/debit cards, and cryptocurrencies.

AI-Powered Investment & Expense Analytics

The system tracks user expenses through its interface, which provides AI-based budgeting suggestions while monitoring investments by showing immediate market analysis.

Multi-Factor Authentication & Fraud Prevention

The security system of user accounts includes biometric authentication together with OTP verification and AI-based fraud monitoring for identifying abnormal transaction activities.

Real-Time Financial Dashboard

This financial dashboard generates real-time data visualizations that reveal expenses and savings performance as well as investment status to users through analytic graphs.

A finance company based in Georgia sought to expand digital capabilities through the development of a feature-rich application in the fintech domain. The company required a trustworthy technology firm to develop a high-quality solution that would scale and meet regulatory requirements.

Melonleaf Consulting transformed our financial technology concept into operational functionality. Their special expertise in secure transaction management as well as AI analytical capabilities, together with user experience creation, helped our company create a revolutionary payment solution for customers.

The client achieved a successful fintech app release through their partnership with Melonleaf Consulting, which yielded an exceptional financial application. Through its platform, the solution caters to financial security needs and automated financial tracking as well as providing AI-powered analytics for improved financial health optimization. The app has created a standard that qualifies as the most secure, intelligent, and user-friendly solution in the current fintech application market.

- Enhanced Financial Security

- User-Centric Design

- AI-Powered Personal Finance Insights

- Multi-Currency & Multi-Payment Support